What to do when your bookkeeper or accountant is retiring

If your bookkeeper has shared that they are planning to retire, you may be wondering what this means for your business. We have helped several business owners through this exact situation. Most of them did not realize how much their bookkeeper handled until they started thinking about the transition.

Transform Your Business With a Money Mindset Shift!

Most business owners think growth comes from working harder, selling more, or adding new offers. But one of the biggest shifts we see in successful businesses starts somewhere else.

It starts with how you think about money!

Thinking About Hiring a Business Coach in 2026?

f hiring a business coach is part of your plan for 2026, there is one thing you need before you start.

Costly Bookkeeping Mistakes Businesses Made in 2025

As we reviewed 2025 financial records, the same bookkeeping mistakes showed up again and again. Not because business owners were careless, but because the impact was never clearly explained. Below are some of the most costly issues we saw and how to fix them moving forward.

How Much to Set Aside for Taxes in Your Business

One of the most common questions we hear from small business owners is:

“How much should I be setting aside for taxes?”

Many Utah business owners—contractors, medical and dental practices, wellness providers, real estate professionals, agencies, and other service-based businesses—were never really taught how to plan for taxes throughout the year.

So they:

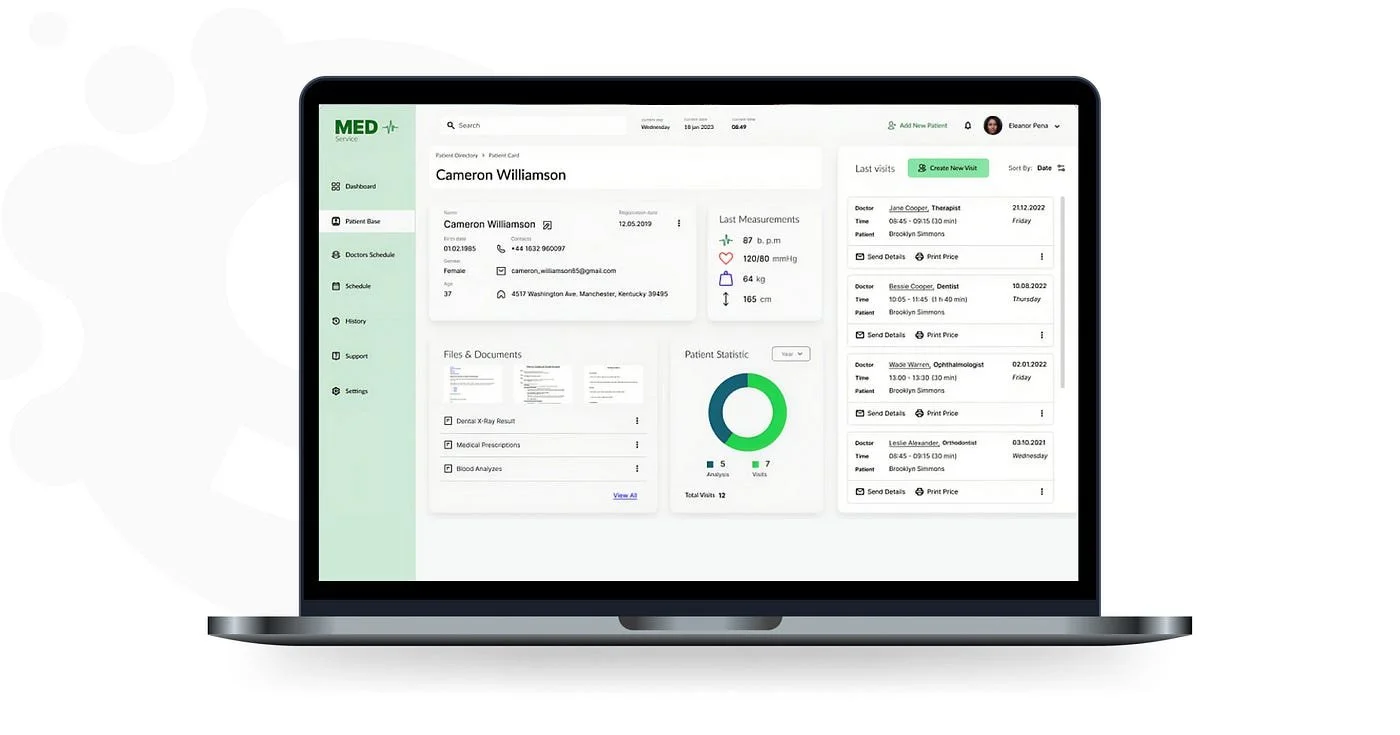

When Your Utah Healthcare Clinic Should Outsource Bookkeeping

If your Utah clinic is falling behind on reconciliations or struggling with reimbursement tracking, it may be time to outsource bookkeeping. Here are the signs your practice is ready.

The Financial Side of Running a Utah Medspa: What Every Owner Should Track

Utah’s medspas face unique financial challenges—from inventory tracking to prepaid packages. Learn the key bookkeeping systems every medspa owner needs to stay profitable.

Insurance Reimbursements: How Poor Tracking Can Cost Your Utah Clinic Thousands

Poor insurance reimbursement tracking can cost Utah clinics thousands each year. Here’s how medical, dental, and chiropractic practices can protect their cash flow with better bookkeeping systems.

How Utah Clinics Can Keep Their Books Audit-Ready All Year (Without the Stress)

Keeping your clinic’s books audit-ready doesn’t need to be overwhelming. Learn the simple bookkeeping systems Utah medical, dental, medspa, and chiropractic offices can use to stay organized year-round.

The Top Bookkeeping Mistakes Utah Healthcare Clinics Make (and How to Avoid Them)

Most Utah clinics struggle with the same bookkeeping mistakes—missed reimbursements, messy accounts, and tax-season stress. Here’s how to avoid them and keep your practice financially healthy.

Cash Flow Mistakes Small Business Owners Make (and How to Avoid Them)

Cash flow is one of the biggest challenges small business owners face—especially here in Utah, where many service-based businesses experience seasonal slowdowns, fluctuating client work, or unpredictable payment cycles.

The good news? Most cash flow problems come from a handful of habits we see over and over again. And once you understand what’s causing the issue, the fix is usually simple.

Here are the most common cash flow mistakes we see with Utah small businesses and what to do instead:

When to Move from DIY Bookkeeping to Professional Support

Many Utah small business owners start out doing their own bookkeeping. It’s practical in the beginning, keeps costs low, and helps you stay close to your numbers.

But as your business grows, there comes a point when DIY bookkeeping stops being “smart and scrappy” and starts slowing you down.

At Clarke Financials, we see the same patterns come up again and again with service-based businesses here in Utah—contractors, medical and dental practices, wellness clinics, real estate investors, attorneys, consultants, and more. These patterns are usually a clear sign it’s time to bring in professional support.

Here are a few of the most common signs.

LLC vs. S-Corp: What’s the Difference for Small Business Owners?

When you’re just starting your business, an LLC is usually the easiest and smartest choice. It’s flexible, protects your personal assets, and keeps your setup simple. But as your profits grow, you might be leaving money on the table if you don’t explore the S-Corp election.

The Top 5 Reasons Your Business Needs a Professional Bookkeeper

As a business owner, you wear many hats. From managing operations to building client relationships, your to-do list is endless. But one critical area that often gets overlooked or deprioritized is bookkeeping. While it might seem like a task you can handle yourself or push off until tax season, having a professional bookkeeper can be a game-changer for your business. Here are five compelling reasons why outsourcing your bookkeeping is one of the smartest investments you can make.

What Is an Accountant?

When running a small business, financial management can feel overwhelming. That’s where accountants come in. But what exactly does an accountant do, and how can they help your business thrive?

In this post, we’ll explore the role of an accountant, how they differ from bookkeepers, and why having professional financial support is crucial for small businesses in Utah County.